Is the banking industry really about to meet its doom?

If you take any interest in the financial world it is impossible to escape the fintech narrative. The financial press is dominated by how much a new start-up has raised, crazy valuations, or predictions of mass unemployment in the City. Shoreditch is buzzing with boffins in small offices creating new systems. Meanwhile, City towers and Canary Wharf are filled with the smell of anxious, suited individuals wondering what the hell is going on. It’s a unique time in history – or so they would lead us to believe.

Haven’t we been here before? Didn’t 1999 and the dotcom boom teach us anything?

What we know from the late 90s

It was the best of times, it was the worst of times. It was the age of wisdom, it was the age of foolishness. Start-ups, valuations, small offices buzzing and suited executives in utter confusion. It was the retail sector that was under pressure then as the established players struggled to adapt but the banks too had their challenges. Stockbroking was under pressure as online execution boomed and distributors were under threat from online channels.

The end was predicted but the end never arrived. Natural selection took hold.

Start-ups

So what became of the start-ups? Lots of them failed as they had no sustainable customer base and, ultimately, no cash. There were a select few that got the timing of the floatation and the proposition right. They are highly successful today and you know who they are. Some start-ups were simply the innovation teams of the big corporates and were subsequently acquired, re-badged and continued under the branding of an established organisation.

And the established players?

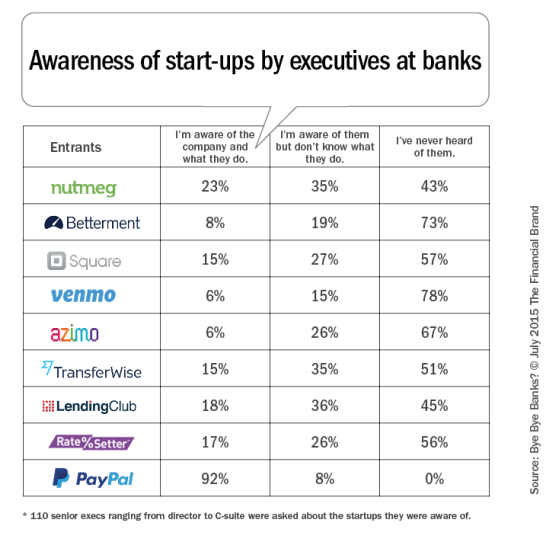

The response was mixed. There were the arrogant or sluggish few who chuckled at these pony-tailed flash Harrys and simply carried on as usual, thinking the storm would pass. We found this research, last year, quite interesting from Monticello.

How long these executives remain in positions of power is open to debate. Keeping an eye on the activity of new entrants is an important discipline.

Then there were those who tried to develop their own online proposition but didn’t really have the know-how. They were good at steering big ships but not so good at harnessing new technology and being nimble. It required a different mind-set, which they didn’t have.

Some acquired to stay alive and others successfully adapted and thrived (like John Lewis). What we can say is that the market is still in a state of flux and some of those traditional players, who believed they had weathered the storm, are constantly seeing their market share and margins eroded. What felt like survival now looks like a slow decline as those who have failed to change their business models sufficiently are being constantly gnawed at by the likes of Amazon.

So what’s going to happen?

Some very wise men have commented on the pitfalls of forecasting…

“Prediction is very difficult, especially if it’s about the future.” (Nils Bohr, Nobel laureate in Physics)

“I have seen the future and it is very much like the present, only longer.”(Kehlog Albran, The Profit)

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.” (Lao Tzu, 6th Century BC Chinese Poet)

We aren’t going to make any bold predictions. However, our experience in supporting large financial institutions and fintech companies leads us to the following considerations…

- Headlines aren’t created by saying ‘there’s going to be a gradual and ongoing shift in the market. This will see market share eroded by new entrants and competitors who adapt to the increasingly open and technology-led basis of competition.’ That’s all too dull and long-term for the press. Headlines are created by saying “new entrants boom, traditional players die.” The fact that current MI packs show a much slower evolution makes traditional players disbelieving and complacent. There may not be a volcanic eruption but that doesn’t mean the tectonic plates aren’t moving.

- Big financial institutions are under pressure from the low confidence levels of their customers and the threat of bright and shiny new companies nibbling away at them. So what are the captains of these gigantic companies doing…

- Some won’t react and will drown as they sleep.

- Some will react too slowly to make the life raft.

- Some will over-invest in inadequate technology and look on as the pumps fail to save the stricken vessel.

- Some will adapt their operation and keep the vessel afloat, albeit sailing a different course in a different way.

- Fintechs are receiving lots of cash from investors fearful of missing out on the gold rush. Some will have a solid proposition, spend the investment wisely, and have a robust commercial plan that maps a route to successful trading. Some will be acquired and rebadged. Some will run out of cash and the dreams of a bright individual, starting up a company, won’t become a reality right now. Maybe they will in the future though.

So, what’s our advice?

- One thing we have seen first-hand is that some people in the industry don’t draw up dividing lines between the old and the new. They have found a new way to work harmoniously and for their mutual benefit. They are open minded and create new propositions which work…the large player outsourcing to a technology provider that can solve a specific problem in a clever way. We have direct experience in helping some of our clients to do this and they are highly successful as a result.

- If you want to create a headline, say something extreme. Anthony Jenkins did just that with his predictions on job losses.

- But you don’t have to say something extreme, nor carry the clout of an ex-FTSE CEO, to get your message out. You can come up with well thought-out plans which will enable you to carve out a niche and define yourself in very congested industry. We can help and we advise large and small companies on their plans.

People are talking up the great divide between established players and fintech. That’s how other people would describe them. Only we don’t believe there’s a divide.

There isn’t old and new. There isn’t a beginning and an end. There’s simply a change in the dynamics of the industry and the pace of evolution has increased a little bit. We believe you can create lots of opportunities during this dynamic period.